Navigating tax records doesn’t have to be overwhelming anymore. The IRS now offers a convenient way to access your tax transcripts online in 2024. Whether you need it for a loan, mortgage, or personal record, understanding the steps and benefits of this service can save you time and hassle. Here’s a simple guide to help you access your IRS transcript with ease.

IRS Transcript Online 2024

| Feature | Details |

|---|---|

| Service Name | IRS Transcript Online |

| Eligibility | Must have valid SSN or ITIN, email, and financial account access |

| Access Methods | Online or by mail |

| Processing Time | Immediate for online, 5-10 business days for mail |

| Benefits | Easy tax verification, faster loan applications, detailed tax record review |

| Official Link | IRS Get Transcript Page |

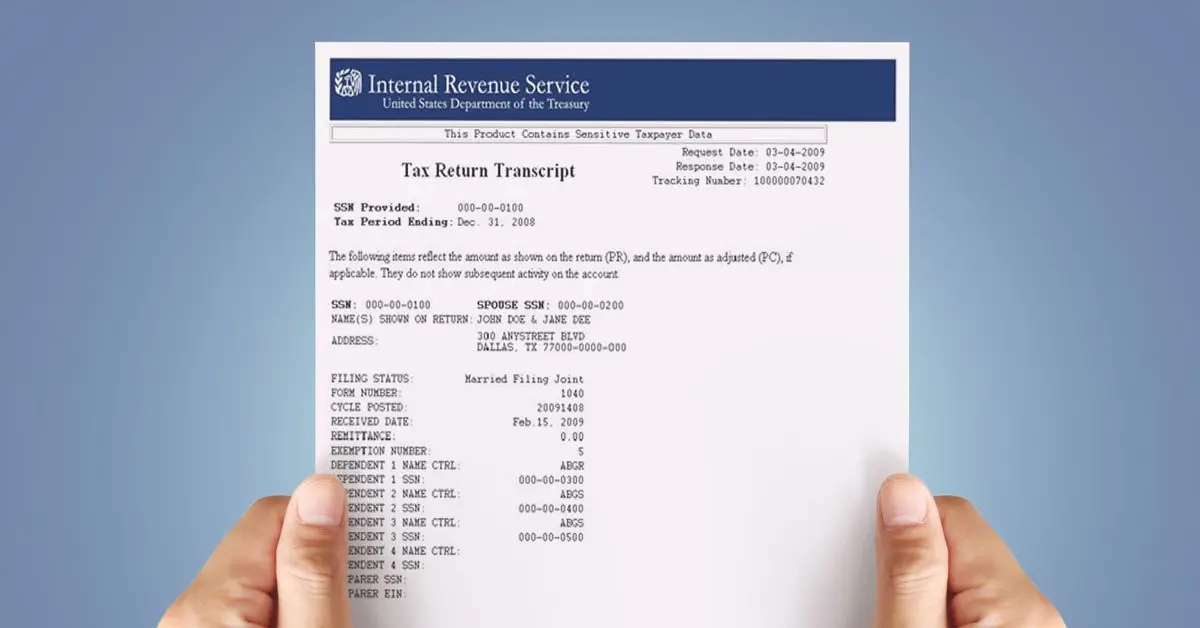

What is an IRS Transcript, and Why Do You Need It?

An IRS transcript is a summary of your tax information, including details like adjusted gross income, filing status, payment history, and account changes. It’s different from a copy of your actual tax return but just as valuable for:

- Applying for mortgages or loans.

- Verifying income for employers or other purposes.

- Fixing errors on past tax returns.

- Resolving disputes with the IRS.

With online access, you can get this information instantly, making it a practical tool for anyone needing a quick and reliable financial summary.

How to Access Your IRS Transcript Online

Accessing your IRS transcript online is simple. Just follow these steps:

- Visit the IRS Website: Start by going to the IRS “Get Transcript” page.

- Choose Your Access Method: Decide between:

- Get Transcript Online: Immediate access to your tax records.

- Get Transcript by Mail: Delivery within 5-10 calendar days.

- For Online Access:

- Create an Account: Use the IRS login portal to set up an account with ID.me. You’ll need:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- A photo ID (driver’s license, passport, or state ID).

- An email address and access to a financial account for verification.

- Verify Your Identity: Follow ID.me’s secure process to confirm your identity.

- Log In: Once verified, log in to view and download your transcript instantly.

- Create an Account: Use the IRS login portal to set up an account with ID.me. You’ll need:

- For Mail Access:

- Request by providing your SSN or ITIN, date of birth, and your address as listed on your latest tax return.

Who Can Use the Online Service?

To access your transcript online, you must meet these requirements:

- A valid SSN or ITIN.

- A working email address for account updates.

- Access to a credit card, mortgage, or loan account for verification.

- A government-issued photo ID for identity confirmation.

If you prefer mail delivery, you’ll only need your SSN or ITIN and your address.

Benefits of Accessing IRS Transcripts Online

- Instant Access: View, download, or print your transcript in minutes.

- Convenience: No need to call the IRS or search through piles of paperwork.

- Comprehensive Records: Access details like payment history and account adjustments.

- Secure Platform: The system ensures your sensitive data stays protected.

- Eco-Friendly Option: A paperless process reduces environmental impact.

How People Use IRS Transcripts

- Mortgage and Loan Applications: Lenders use them to verify income and financial history.

- Fixing Tax Errors: Find discrepancies and correct mistakes quickly.

- Tracking Refunds: Check on past refunds and payments.

- Tax Planning: Get a clear picture of your financial history to prepare for the future.

Getting your IRS transcript online is a smart way to simplify tax management. Whether you’re resolving tax issues, applying for a loan, or preparing for next year’s taxes, this service provides fast, secure, and reliable access to your records.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates.