The IRS is taking steps to ensure that up to 1 million eligible taxpayers who missed out on the third round of coronavirus stimulus checks will finally get their payments. This move targets $2.4 billion in unclaimed funds, with payments of up to $1,400 set to go out automatically to eligible individuals.

Background: What Were the Stimulus Checks?

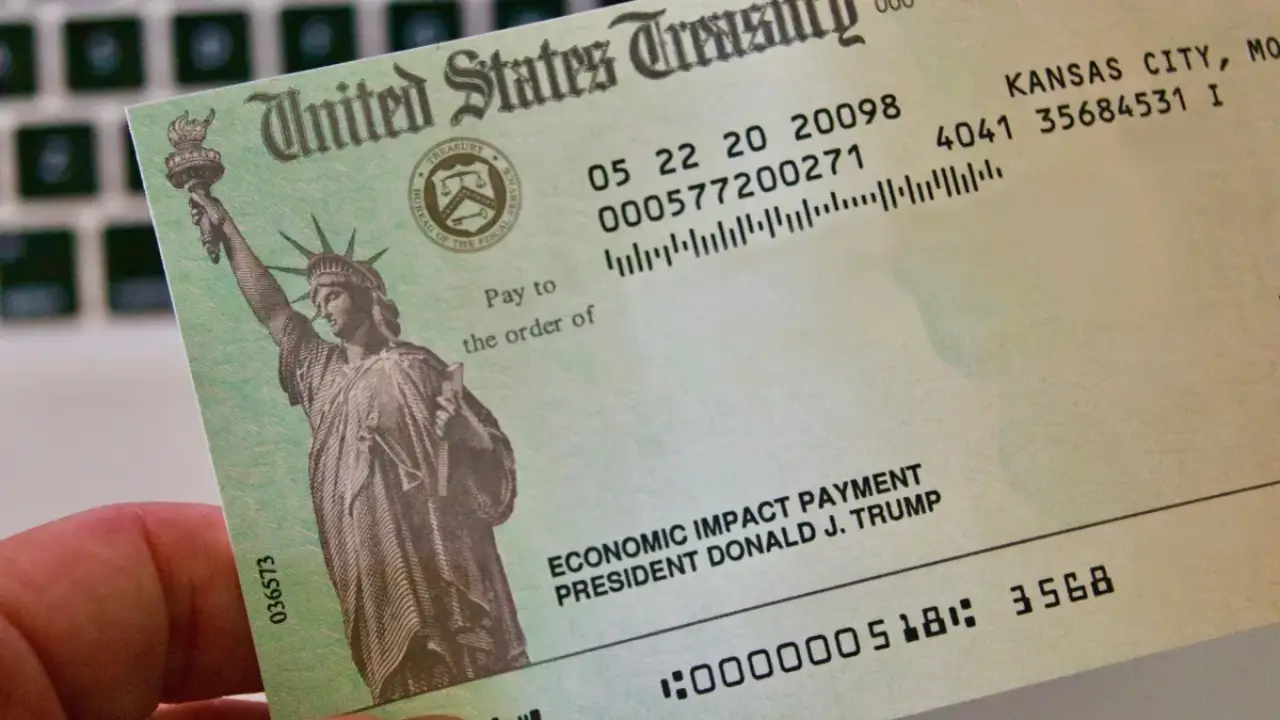

Between 2020 and 2021, three rounds of stimulus checks were sent to American taxpayers to provide relief during the global pandemic. These payments were approved under both President Donald Trump and President Joe Biden:

- First payment: Early 2020, up to $1,200.

- Second payment: Early 2021, up to $600.

- Third payment: Later in 2021, up to $1,400.

In total, over 476 million payments were issued, amounting to more than $800 billion.

While most eligible individuals received their payments, some taxpayers missed out on the third check. Now, the IRS is working to ensure these unclaimed funds reach those who qualify.

Who Is Eligible for the Payment?

The upcoming payments are for individuals who qualified for the third stimulus payment but didn’t claim it on their 2021 tax returns. Here’s how to know if you’re eligible:

- Filed a 2021 tax return but didn’t claim the Recovery Rebate Credit:

- If you left the field for the Recovery Rebate Credit blank or filled it as $0 when you were eligible, the IRS will send your payment automatically.

- Didn’t file a 2021 tax return but qualify for the credit:

- You’ll need to file your 2021 tax return by April 15, 2025, to claim the credit.

When Will Payments Be Sent?

The IRS has outlined a clear timeline for these payments:

- Payments will be sent automatically in December 2024.

- Most eligible taxpayers will receive their money by late January 2025.

This process is designed to be hassle-free. According to IRS Commissioner Danny Werfel, “We’re making these payments automatic, meaning people won’t need to file an amended return to receive their money.”

How Will Payments Be Delivered?

The IRS will issue payments based on the information provided on your most recent tax filing. Here’s how the process works:

- Direct Deposit:

- Payments will be deposited into the bank account listed on your 2023 tax return.

- Physical Checks:

- If your bank account is closed, the IRS will send a check to your address of record.

- Notification Letter:

- You’ll receive a letter confirming the payment.

To avoid delays, ensure your contact information with the IRS is up-to-date.

What You Should Do Next

If you believe you’re eligible but haven’t filed your 2021 tax return, it’s not too late. File your return before the April 15, 2025, deadline to claim your payment.

For taxpayers who already filed their 2021 returns but missed the credit, there’s no need to take action—the IRS will handle the payment process for you.

This initiative underscores the government’s commitment to ensuring that pandemic relief reaches all eligible Americans. Whether you missed the third stimulus payment due to oversight or lack of awareness, the IRS is offering a second chance to claim what’s rightfully yours.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates.