“Here Are The Bank News At MJP”

Shareholders at TD Bank are reportedly considering firing the CEO in light of the ongoing money laundering inquiry, as reported by Reuters.

There may be a leadership change at TD Bank due to the problems with its anti-money laundering (AML) policies.

Ten shareholders and two analysts were surveyed for an August 28 Reuters story that stated the appointment of a new chief executive officer is anticipated in the year 2025.

Assuming the bank resolves its anti-money-laundering concerns, many shareholders think an outsider with a background in American banking would be a great leader.

A portion of the bank’s holding in Charles Schwab will be sold to offset losses, and a staggering $2.6 billion has been placed aside to pay the AML penalty.

A portfolio manager at TD shareholder Nicola Wealth, Ben Jang, made the following observation: “Once we get past these rocky waters, and there is a little bit of light at the end of the tunnel, maybe that will help create more clarity for leadership change.”

According to TD Bank’s representative, the bank takes its succession planning seriously and takes pride in its strong senior executive team.

SEE MORE –

US Bank Announces Shocking Closure of Branch Location

Additionally, the bank did not want to respond, according to PYMNTS.

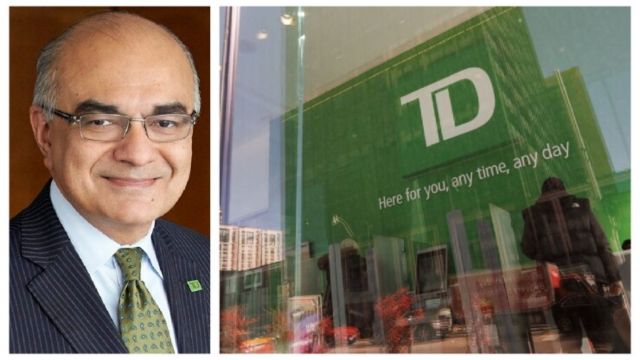

With TD’s recent growth into the United States, where it runs roughly 1,150 branches—more than in Canada—CEO Bharat Masrani has been at the helm for ten years.

These developments follow the bank’s most recent quarterly earnings report, which detailed a $2.6 billion provision—an increase of $450 million from the prior quarter—connected to the possibility of an investigation into its AML program.

As a result of increased scrutiny from U.S. regulators, TD has begun to address its anti-money laundering (AML) processes.

With some workers facing criminal accusations and disciplinary measures, TD fired more than a dozen workers earlier this year.

The anti-money-laundering procedures of banks are coming under more and more inspection.

According to last month’s study, there are serious repercussions for banks and fintech companies that do not meet the criteria.

As authorities continue to debate how best to use cutting-edge innovation to fortify financial institutions’ defenses against money laundering and fraud, the rules regulating these areas may undergo revisions.