MJP –

Mortgage rates fell for the sixth straight week last week, but mortgage demand still seems to be waiting for something bigger.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.29% from 6.43%, with points falling to 0.55 from 0.56 (including the origination fee) for loans with a 20% down payment, according to the Mortgage Bankers Association. That is the lowest level since February 2023 and nearly a full percentage point lower than the same week one year ago.

“Treasury yields have been responding to data showing a picture of cooling inflation, a slowing job market, and the anticipated first rate cut from the Federal Reserve later this month,” said Joel Kan, vice president and deputy chief economist at the MBA.

Total mortgage demand, however, rose just 1.4% for the week, according to the MBA’s seasonally adjusted index. The results also included an adjustment for the Labor Day holiday.

Refinance applications only increased 1% week to week, but were 106% higher than a year ago. That may sound like a massive increase, but the numbers were so low last year, that even with that large gain, refinancing is still historically low.

SEE MORE –

Upcoming Years! 5 Services Middle-Class Americans May No Longer Afford in the Next 5 Years

“There is still somewhat limited refinance potential as many borrowers still have sub-5 percent rates. It is a positive development that there are homeowners who can benefit from a refinance as rates continue to move lower,” added Kan.

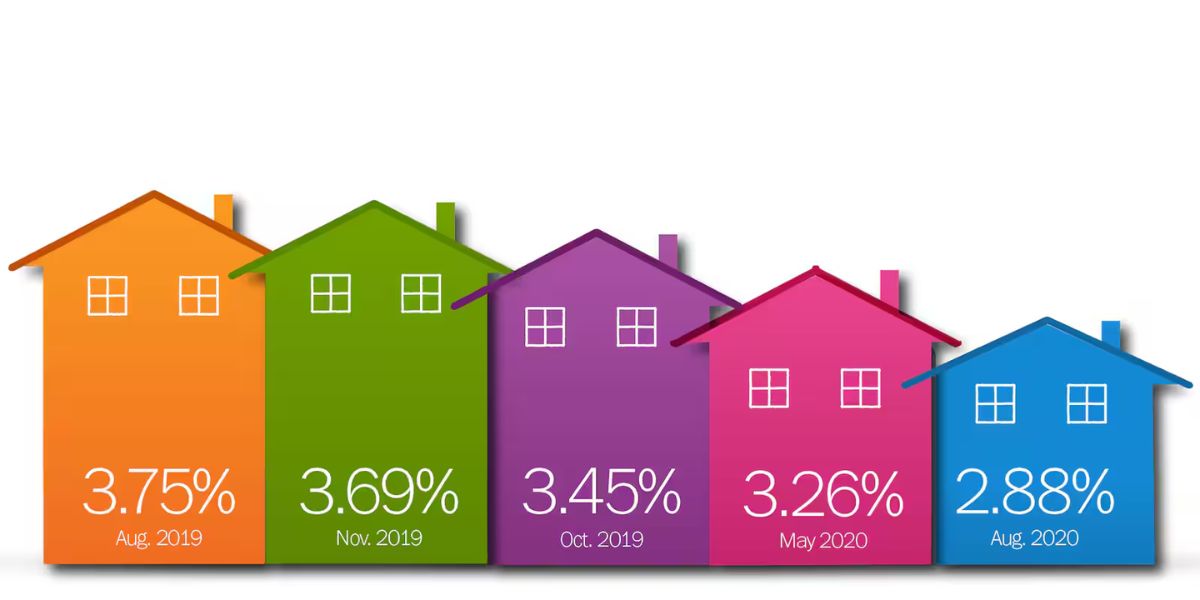

Most of those refinancing likely bought their homes in the last two years, when rates had moved significantly higher off of record lows.

Applications for a mortgage to purchase a home rose 2% for the week but were 3% lower than the same week one year ago.

“Despite the drop in rates, affordability challenges and other factors such as limited inventory might still be hindering purchase decisions,” Kan said.

Mortgage rates continued to move lower to start this week, according to a separate survey by Mortgage News Daily, but the monthly release of the consumer price index, a measure of inflation, on Wednesday could impact the direction of rates more sharply in either direction.

“If it weren’t for the fact that this is one of the only big ticket reports that comes out in the blackout period leading up to a Fed rate cut where the size of the said cut is a matter of debate, we would confidently say CPI is almost completely inconsequential. But because of all that ‘stuff,’ we can’t rule out a volatile response to a big beat/miss,” wrote Matthew Graham, chief operating officer of Mortgage News Daily.